Lyle prefers pen/paper over computers, and learns something new each day.

Surveys are an invaluable tool in producing strong research. However, they are only effective when used correctly. Surveys are crucial to company success, whether used to measure customer service satisfaction or conduct market research.

Before starting the conversation, establish a clear goal for the questions you will be asking. What insights are you trying to collect in this survey? How can you use those insights to make decisions? Determining the type of data you want to gather will help in asking practical survey questions.

What are some best practices that turn good surveys into great ones? Begin your strategy keeping the following concepts in mind.

Think of designing a survey as putting puzzle pieces together. Online survey software is precise in recruiting survey respondents, narrowing down the research purpose, and using innovative platforms. Instead of putting the pieces together on your own with free survey tools like Google Sheets or Google Forms, try using these products and services for survey creation.

Survicate lets you enroll any customer experience strategy and run NPS, CSAT, or CES surveys in minutes. You can access 125 expert-made survey templates already on the free plan.

(Source: Survicate’s NPS survey template)

(Source: Survicate’s NPS survey template)

Paperform is modern survey maker software fit for professional use. Thanks to its robust customization features, it's easy to create surveys and questionnaires that truly represent your unique company's brand. All Paperform plans come with 500+ designer-made templates.

(Source: Paperform)

Typeform is an online survey platform used to create polls, quizzes, and forms. By using online tools to collect data, you’ll stay organized, making responses easier to analyze.

(Source: Typeform)

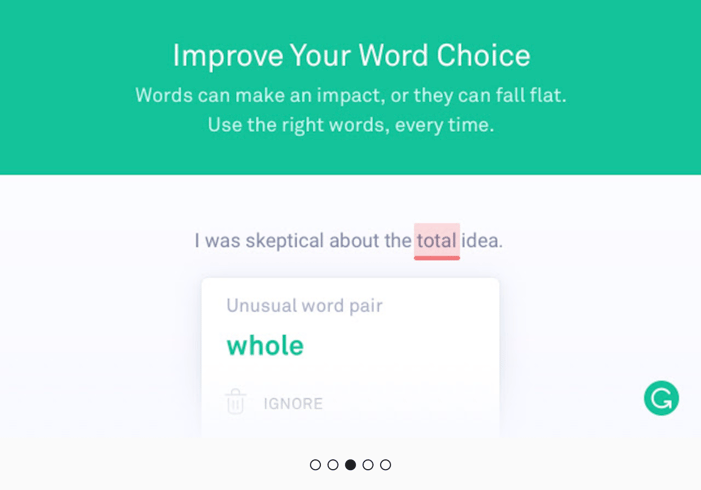

You’ll also need to come up with drafts for each question type. Rather than relying solely on your writing abilities to draft a question, use tools like Grammarly to write clearly.

(Source: Grammarly)

The best surveys use multiple types of questions, which can consist of:

Each type of question serves a unique purpose in gathering accurate data. One of the benefits of tools like the JotForm Survey Maker is that research teams can collect initial information about their target audience or pair the quantitative method with more meaningful insights later.

Once you’ve put the pieces in, you’ll be ready to get started creating your survey.

When recruiting your sample (the people who respond to your survey), select the most relevant respondents to answer your research questions. In some cases, such as an employer surveying its employees to measure employee satisfaction, the sample is relatively straightforward.

In a customer satisfaction survey, you would need to determine your customer profile according to your research. Consider:

Take care to recruit your sample selectively. Sometimes, you may find that a diverse array of ages and demographics might work best for your responses. In this case, recruiting “general population participants” is the best fit.

Explain to your respondents why participating matters. Why are they doing this? Who will be reading their responses?

You wouldn’t be creating your survey without reason behind your research or without a greater goal to achieve. Reasons to develop a study include:

Give your respondents an idea of how they are helping by clearly stating your goals.

For example, if you’re creating a survey to measure customer satisfaction, explain how the survey results will improve future products. When surveying employees, explain that employee responses help to develop essential changes like leadership and structure. This personal interest will yield more accurate results.

In some cases, your survey may ask questions that require respondents to share sensitive information.

For example, an employee survey about office culture may ask about the behavior of coworkers. Be sure to justify these questions and give your respondents an idea of who will be accessing the information. Explain to respondents that their personal information — such as their name and email addresses — is confidential and ensure their comfort throughout the survey.

![]()

Pro Tip: Remember to include a “prefer not to answer” option for questions about personal experiences.

Remember in high school when the person sitting next to you filled in random bubbles on a test to leave for lunch early? Chances are, the same thing happens for your respondents while giving their responses. When a survey is too long or unfocused, people are less likely to pay attention or stay active.

If you’re having a hard time keeping it short, it may be time to rethink your questions. Re-focus on what you hope to achieve through this survey and what you will use the research for. Keep questions concise to be as straightforward as possible.

The more words on the page, the more likely the respondent is to develop their understanding of the question and provide high-quality survey responses, improving your overall survey response rates.

Products and experiences change over time. Your survey templates and design are no different.

When asking questions about a product, be sure to include information about when your respondents may have used the product. For example, a respondent who used a product last year may have a different experience than a respondent who just used the product.

Use time frames to your advantage in studying what works with the product. Then, find areas that need to be improved as the development progresses over time.

![]()

Example: “Have you used Product X?”

Don't ask your respondents if they have used a product. Ask how long it’s been since they used it.

![]()

Example: “Have you used Product X in the last:

Write questions as questions, not as statements.

![]()

Example: “How would you rate a slice of Joe’s Pizza, considered to be New York’s best slice?”

This question already hints that consumers praise Joe’s Pizza for its slices, which creates a bias for respondents. By including the phrase “considered to be New York’s best slice,” the respondent is more likely to conform to how one writes the question. They won’t write their own opinion of the product.

Besides, using words like “could” and “might” can also leave your audience to interpret a question in different ways. When phrasing questions like normative statements (making a judgment or opinion), it makes the answers given by your respondents less accurate. Remember to stay focused on the purpose of your survey: accurate data.

In any list of multiple choice answers, remember to offer an entire spectrum of response options. That way, your respondents will reflect on the varying degrees in which they identify with a statement. Here’s an example.

![]()

Example: "How likely are you to purchase a product packaged in a plastic bottle?"

The survey does not offer respondents who never purchase plastic bottles to select the options available above. Instead, start by assigning the highest possible value (the most robust agreement) and work evenly toward the lowest possible deal (high disagreement).

This method applies to any rating scale questions.

The questions that are most direct often yield the best results. If your respondents aren’t sure how to answer questions, they may respond differently. Explore one idea at a time.

Some ways to re-think survey-making preparation include:

Wording

Are similarly designed questions grouped (i.e., does the True or False section mix into the open-ended responses)?

Because of how someone worded this question, respondents may offer suggestions for a wide range of problems. These problems can include the website's interface, the design, the user experience, or the product itself. As an alternative, make your question more specific by asking: “What suggestions do you have for improving the design of our website for users?”

This question was designed directly toward a single subject, leaving less room for the respondent to interpret the question differently. In addition, by making sure each question only focuses on one research idea at a time, your data will be more robust.

Overall, remember that the design of the survey will determine how effectively you can conduct your research. Researchers often use sample surveys to help design a list of open-ended and multiple-choice questions before creating a survey. Straightforward questions and clear answers will make it easier for respondents to deliver accurate responses and for your team to build your survey. It will also make your job easier when collecting and analyzing the responses to generate a net promoter score (NPS).

Learn how you can optimize your customer insights with artificial intelligence using our free resource guide below!

© 2024 | All rights reserved