.webp)

Trends

How to Calculate Your Sample Size Using a Sample Size Formula

.png)

.png)

Read More

.png)

.png)

.png)

Maria Noesi

November 25, 2021

Remesher

.webp)

Trends

How to Calculate Your Sample Size Using a Sample Size Formula

.png)

.png)

Read More

.png)

.png)

.png)

November 25, 2021

Remesher

.webp)

Trends

How to Calculate Your Sample Size Using a Sample Size Formula

.png)

.png)

Read More

.png)

.png)

.png)

November 25, 2021

Remesher

.webp)

Trends

How to Calculate Your Sample Size Using a Sample Size Formula

.png)

.png)

Read More

.png)

.png)

.png)

November 25, 2021

Remesher

.webp)

Trends

How to Calculate Your Sample Size Using a Sample Size Formula

.png)

.png)

Read More

.png)

.png)

.png)

November 25, 2021

Remesher

.webp)

Trends

How to Calculate Your Sample Size Using a Sample Size Formula

.png)

.png)

Read More

.png)

.png)

.png)

November 25, 2021

Remesher

3 Common Market Research Blunders to Avoid

Mastering the skill of accurate market research enables you to reap its significant and far-reaching benefits. Get a grasp of common (and dangerous) market research blunders, and learn some tips and tricks to polish your market research strategy!

In many ways, effective market research demands an immense amount of precision in both business and competitive strategy analysis. Every step in your research approach should be accurate, in order to gain unbiased insights, and truly representative target market data.

Mastering the skill of market research is especially important because of the wide breadth of uses cases of which it applies. The process is essential in product development, campaign launches, monitoring your company’s brand awareness, customer satisfaction, and competitor analysis.

Simply put, market research has a far-reaching impact on business no matter the type of industry you’re in. And that’s why it’s so important to get right.

Whether you’re conducting your first study or your 100th, look out for these common market research blunders!

Lack of Competitive Product Analysis

When crunch time comes, we can’t deny that it’s tempting (even for a moment) to skip competitive analysis. However, this must be done before zooming straight into the strengths and weaknesses of your own product. After all, isn’t market research more about your product, than anyone else’s?

As it turns out, not evaluating your competition equates to losing a critical piece of your market research puzzle. Skipping competitive research means you won’t see an accurate picture of your product’s place in the market. It also obstructs your understanding of the best time and process for launching your product.

That’s not all.

Even when designing, developing a product roadmap, or launching a product, a lack of competitive analysis cause a loss of understanding in:

- your competitors’ price points

- your competitors strengths and weaknesses

- your own competitive advantage

- how competitors are marketing their products

- your competitors own product problems and challenges (which may very well be similar to your own)

Ultimately, this insight will impact the way your product should be positioned.

It’s important to know who your competitors are but even more crucial to suss out what makes them competition.

Get It Right:

To conduct robust competitive analysis, try invest more in competitive monitoring and different types of analysis. Many companies appear to have caught on to this too. Crayon reports that over half of companies use at least one competitive intelligence software tool. And, 39% use two or more tools to support their market and competitive intelligence efforts.

From SpyFu to Google Trends, for example, these tools are great resources to understand search terms popular in your industry and with competitors. Try them out to gain greater insight into your competition!

In addition to using tools, tap your team resources both internally and at competing companies. Ask your customer service team for customer feedback, or ask product managers for insights from their previous companies. This method can inform surprising insight from competing business strategies.

Want to stay ahead of the competition? Make your market research process agile, and conduct competitive analysis (for product or concept) frequently.

Using dated market research

A common and dangerous mistake is to conduct market research once, and use those findings from the dinosaur era -- just kidding! -- as benchmarks or findings for consumers today. This inevitably neglects to factor in consumer, product, and category disruptions that have happened in recent years.

Take industry disruptions, for example.

In 2018 alone, Inc. reports that insurance, weddings, classroom education, and law industries have all been disrupted with the emergence of innovative technology and well-funded startups. Use of outdated market research means missing out on crucial updates, and losing opportunities for product repositioning amidst new changes.

Get it Right:

To stay in touch with your target market, competition and business environment, conduct regular market research!

There are a variety of market research tools that can help predict whether your campaign, product, or feature will be successful. Typeform, for instance, is a specialized form-builder that enables you to design customized and user-friendly online forms (even including contests, landing pages, and payment forms).

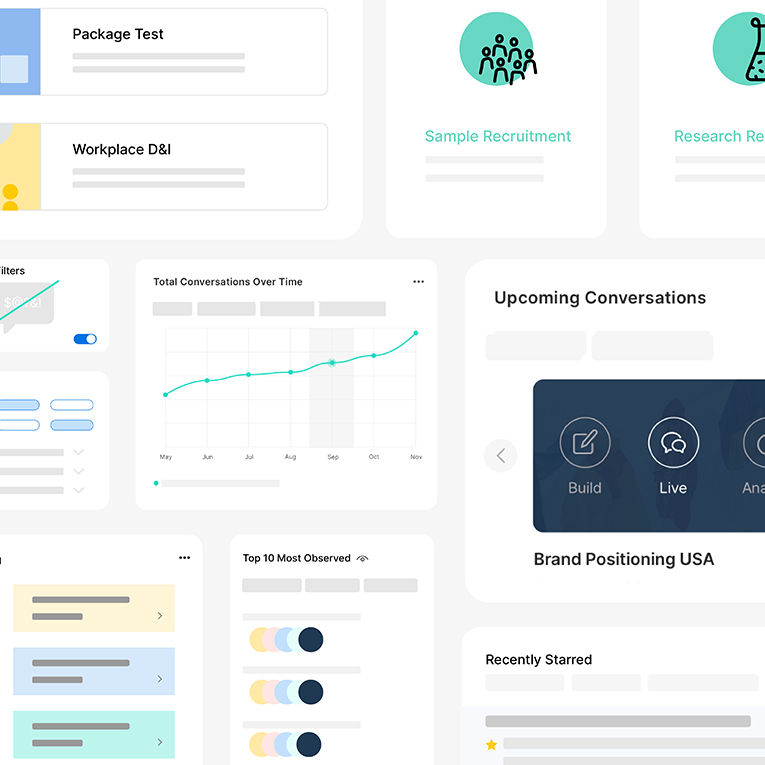

Interested in finding a fresh and innovative way to shake up your market research process? Remesh’s online focus group platform could come in handy for you to gather qualitative insights at a quantitative scale. In the office, tap your project management team for recommendations on organization in online documents.

While market research may not be a time-sensitive activity, there are various product development phases where it is essential. Here’s a quick, non-exhaustive checklist of important phases to conduct market research:

- when you are starting your business

- when expanding an existing product

- when introducing a completely new product

- when conducting quality checks on your product or service (crucial to pre-empt product or service issues)

- when you are following up on how existing products are being received

- when new campaigns are being launched

- when existing products are offered to new markets

- when gathering current updates on competition

- when understanding industry and economic shifts

Cadbury, one of the world’s best-selling chocolate brands, sets a great example of conducting market research at significant business phases to keep in touch with their target market.

When Cadbury first launched Marvelous Creations Banana Candy™, it encouraged consumers to provide online feedback for the product, and based its marketing strategy on consumer responses.

Continual market research does miracles in guiding strategic decisions, developing your business strengths, and pre-empting new trends and business problems. So you can be the driving force in your industry.

Limited market research into campaign / product development and design

The 1990s brought with it the rise of the “pure” and “clear” product trend, ranging from clear soap to clear alcohol. Pepsi rode this popularity wave and launched Crystal Pepsi in 1992, directly competing with Coca-Cola.

However, the last thing that Pepsi expected was the consumer confusion shortly after the launch of Crystal Pepsi. Consumers wondered why Crystal Pepsi cost more, when it tasted just like regular Pepsi. That disconnect and lack of trust formed the beginning of Crystal Pepsi’s decline in sales.

Competitive market research soon revealed that there were other variables which may have affected the reception of Crystal Pepsi. For example, close competitor Coca-Cola had recently launched its sugar-free, clear cola: Tab Clear. This similarity between Crystal Pepsi and an existing product likely caused the confusion about Crystal Pepsi’s properties.

Limited market research into such variables led Pepsi to launch a new product it thought was different from past products, and tailored to consumer wants. But, the product was ultimately met with consumer confusion and a lack of demand. Unfortunately, Pepsi is not the only victim of this market research blunder, as it is one that happens rather frequently.

Get it Right:

To understand the relationship between a campaign or product and customer perception, you must have a comprehensive understanding of influential factors.

Broadly, here are some common variables that are useful to dig into:

Competitive Environment

- Existing campaigns / products by competitors

- Upcoming campaigns / products by competitors

Customer Expectations

- Functions of your campaign / product (ergonomics, size, form, messaging…)

- Aesthetics (packaging, features…)

Customer Culture

- Customer / viewer values

- Customer / viewer beliefs

Industry Environment

- Industry trends

- Changes in the wider industry that present opportunities or threats to your campaign / product

Now that we’ve established what factors to research into, how do we ensure that our research methodology yields accurate answers?

First, begin by closely examining the questions you ask your customers.

Poorly written questions (like double-barrelled questions) in online surveys or face-to-face interviews often result in skewed data. This leads to an inaccurate understanding of relevant variables.

A good balance of quantitative and qualitative research always helps, too! Surveys can provide primary data, which complements underlying opinions and motivations gained from focus groups and observational data. Insights software like Remesh can help you enjoy the best of both worlds by combining quantitative and qualitative research. With such software at your fingertips, you can understand customers’ expectations and needs in no time!

--

With an accurate and methodical approach, you’ll be able to rapidly reap the full benefits of market research. The challenge, then, comes in watching out for market research blunders that are not as obvious as you think they are. People say that mistakes are the best way to learn. But hey -- what a perk it would be to learn and watch out for them too.

{{cta('ec3457f2-09bd-4632-970b-414a6f6abda2')}}

Stay up-to date.

Stay ahead of the curve. Get it all. Or get what suits you. Our 101 material is great if you’re used to working with an agency. Are you a seasoned pro? Sign up to receive just our advanced materials.